Self-Help Software Built for How Credit Disputes Actually Work

DisputeValet.com empowers you to file your own disputes following proper procedures. Generate bureau-specific letters yourself using templates designed to help you exercise your consumer rights. Track your DIY disputes through typical investigation periods. Monitor responses to your self-filed disputes and plan follow-ups. Access templates created for individual consumers who want to handle their own disputes. This self-help platform provides tools and templates—you control the process and make all decisions about your credit repair journey.

Process-Aligned Designed around actual FCRA procedures

from 50+ early adopters have already joined our waitlist

Self-Help Credit Repair Works

The FTC confirms: "Anything a credit repair company can do legally, you can do for yourself"

DisputeValet.com provides the tools to exercise your federal rights effectively

Federal Rights

FCRA gives you powerful rights to dispute inaccurate information directly

Proven Process

Credit bureaus must investigate disputes within 30-45 days by law

81 Templates

Professional FCRA-Inspired letters covering most dispute scenarios

Common Outcomes When Disputing

Removal of unverifiable information

Correction of inaccurate account details

Update of outdated payment statuses

Deletion of duplicate entries

Legal Response Requirements

Standard investigation period under FCRA

Extended period if additional info provided

Bureau must notify furnisher of disputes

Written results must be provided to you

Why Self-Help Credit Repair Is Effective

• Direct Communication:You deal directly with bureaus and creditors

• No Middleman Delays:Faster response times without third parties

• Full Control:You decide what to dispute and when

• Cost Savings:Save hundreds monthly vs. credit repair companies

• Legal Protection:Same FCRA rights as any credit repair company

• Immediate Start:Begin today without waiting for approvals

DisputeValet.com User Activity

Active Users

Letter Templates

Credit Bureaus

Platform Access

Start Your Self-Help Journey Today

Most users see responses to their disputes within the first 45 days

We believe in transparency and your right to understand the credit repair process

FTC Validated Approach

The Federal Trade Commission confirms: "Anything a credit repair company can do legally, you can do for yourself at little or no cost." DisputeValet.com empowers you with professional tools to exercise these rights effectively.

Your Federal Rights

The Fair Credit Reporting Act (15 U.S.C. §1681) guarantees your right to dispute inaccurate information. Credit bureaus are legally required to investigate within 30-45 days, giving you powerful leverage for corrections.

Realistic Timeline

Results vary based on your unique situation. While many see responses within 45 days, credit improvement is a journey. Accurate negative items typically remain 7 years (10 for bankruptcies), but inaccurate items can often be corrected sooner.

How We Help

DisputeValet.com provides educational tools and templates—not credit repair services. We don't charge advance fees or make guarantees. Instead, we empower you with knowledge and professional resources to manage your own credit effectively.

Your Responsibility: Always dispute only inaccurate information. Making false statements to credit bureaus is illegal. DisputeValet.com helps you exercise your legal rights responsibly and effectively. We comply with all provisions of the Credit Repair Organizations Act (CROA).

Nothing quite like it.

DisputeValet.com provides everything you need to efficiently manage credit disputes, generate professional letters, and track your credit repair progress with advanced automation.

Analytics Dashboard

Track dispute status, monitor deadlines, and analyze your credit repair progress with comprehensive reporting tools

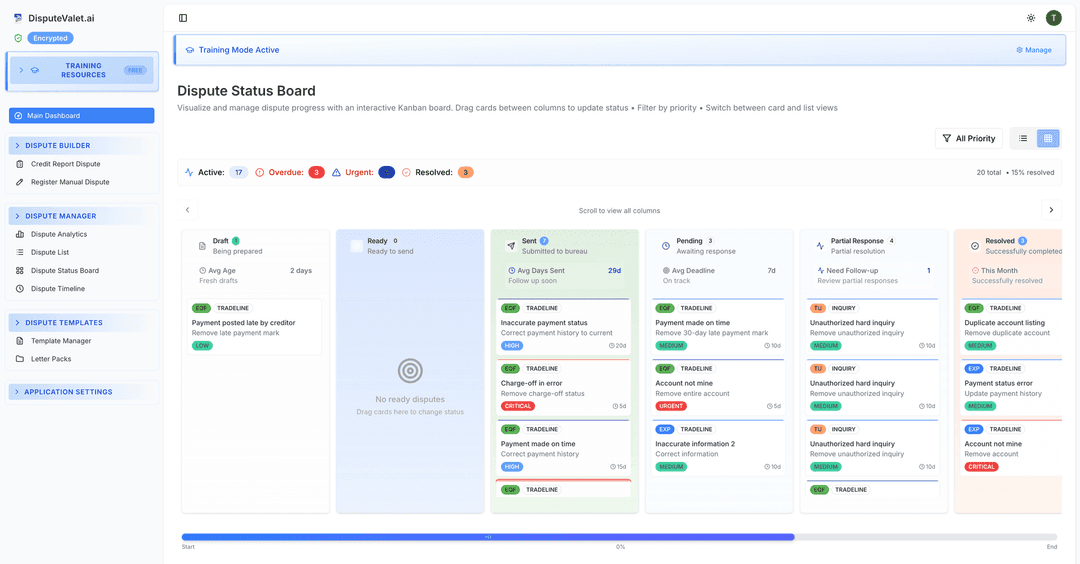

Multi-View Dispute Tracking

Switch between List, Kanban Board, Timeline, and Analytics views to manage disputes exactly how you work best

Deadline Management

Calculate response deadlines, track overdue items, and receive alerts based on standard bureau response times

Rich Text Letter Editor

Powerful TipTap editor with formatting, alignment, and real-time preview for creating compelling dispute letters

Template System

Create reusable templates with merge fields, bureau-specific formatting, and live preview capabilities

Encrypted Letter Packs

Export and import template collections with AES-256-GCM encryption for secure backup and restoration

Credit Report Integration

Enter items from your credit report, manage tradelines, inquiries, and public records with automatic validation

Item Selection Tools

Select multiple tradelines, inquiries, and public records with grouping and bulk dispute creation features

Multi-Bureau Support

Generate bureau-specific letters for Experian, Equifax, and TransUnion with automatic contact information

Dispute Lifecycle Management

Track disputes from draft to resolution with detailed tracking, notes, and outcome documentation

Progress Tracking

Track dispute status, response times, and progress metrics with customizable reporting options

Enterprise-Grade Security

AES-256-GCM encryption, GUID-based security, and version compatibility checks ensure data protection

Local Data Storage

Your credit data is stored locally on your device using browser-based storage, not transmitted to external servers

Every Day You Wait, Negative Items Stay on Your Report

Join many users who took control of their credit today.

Bureaus must respond within 30-45 days by law.

Cancel anytime • No questions asked

Visual Dispute Management Dashboard

Track every dispute from creation to resolution with our Kanban-style visual dashboard. Never miss a deadline or lose track of progress.

- Drag-and-Drop Status Updates.

- Move disputes between stages with simple drag-and-drop

- Deadline Monitoring.

- Automatic calculation of bureau response deadlines

- Success Analytics.

- Track your win rate and identify successful strategies

- Document Storage.

- Keep all correspondence organized in one place

Your Credit Repair Journey Timeline

Typical credit repair timeline based on standard bureau response times

Day 1: Get Started

Sign up, import your credit report, select items to dispute

Average time: 45 minutes

Create 3-5 dispute letters

Response rate: High

Bureaus typically respond

Day 30: First Results

Bureaus respond, first items removed or updated

Day 45: Round Two

Follow up on remaining items with stronger letters

Score improvement

May see improvements

Items addressed

Disputes processed

Day 75: Major Progress

Most negative items addressed, score improving

Day 90: Transformation

Credit rebuilt, goals achieved, monitoring continues

Significant improvement

Potential score gains

Real User Results

See results in first 30 days

Average 90-day increase

Average removed per user

Your results may vary, but our process is proven to work

Start Your 90-Day JourneyJust $25/month • Cancel anytime

Advanced Dispute Generation Engine

Our sophisticated engine goes beyond simple templates - it creates professional letters tailored to your specific dispute situation.

Context-Aware Processing

Adapts language and formatting based on dispute type and content

Bureau-Specific Formatting

Applies formatting preferences for each credit bureau

Date Calculations

Calculates deadlines and response dates based on standard timelines

Conditional Content

Shows or hides paragraphs based on your dispute type

Understanding Your FCRA Rights

Every template references specific sections of the Fair Credit Reporting Act to help you understand your rights under federal law.

Educational information only. Not legal advice. Consult an attorney for legal matters.

Basic Disputes

Fundamental dispute templates for common credit report errors

Address incorrect information, late payments, balances, and duplicate accounts

Includes:

Verification Rights

Your right to request verification of any information in your credit file

Credit bureaus must provide documentation proving the accuracy of disputed items

Includes:

Investigation Rights

Your right to dispute inaccurate information with required investigation

Bureaus must investigate within 30 days and delete unverifiable information

Includes:

Furnisher Obligations

Creditor requirements to report accurate information

Creditors must investigate disputes and correct errors or cease reporting

Includes:

Fraud Protection

Identity theft victim rights and fraud blocking

Request blocks for fraudulent information on credit reports

Includes:

Complex Disputes

Advanced templates for bankruptcy, old debts, and special situations

Handle multi-bureau inconsistencies, debt transfers, and complex account issues

Includes:

Goodwill & Special

Goodwill requests and special circumstance templates

Medical debt, student loans, military protections, and relationship-based appeals

Includes:

81

Total Templates

7

Categories

20

Standard Pack

61

Advanced Pack

Each template cites specific FCRA sections to help you understand your consumer rights

Learn More About Your RightsWrite Professional-Quality Letters

Full-featured document editor with complete formatting control. Create professional dispute letters for exercising your FCRA rights effectively.

- Complete Formatting Control.

- Bold, italic, underline, alignment, lists, indentation - everything you need

- Smart Field System.

- Dynamic variables auto-populate with your information

- Live Preview.

- See exactly how your letter looks before sending

- Custom List Management.

- Choose exactly which fields appear in 'List All' functions

⚡ Pro Tip: Use our Field Selection Dialog to customize exactly what information appears in your dispute lists - account numbers, balances, dates, or any combination you need.

Life-Changing Credit Transformations

First-Time Home Buyer

5 months

"After years of being denied, I finally bought my dream home. The professional dispute letters made all the difference."

Car Loan Applicant

3 months

"Was quoted 18% interest before DisputeValet.com. The savings on my car loan alone paid for the software 10x over."

Collection Dispute Success

4 months

"The validation letter templates were magic. Collections couldn't prove the debts were mine and had to remove them."

Business Owner

4 months

"Clean credit meant I could get a business line of credit. DisputeValet.com helped me launch my dream business."

*The above examples represent individual user experiences and are not typical results. These users experienced exceptional outcomes based on their specific credit report inaccuracies and dispute circumstances. Individual results vary significantly based on credit report accuracy, dispute validity, bureau responsiveness, and user diligence. Many users see modest improvements or no changes. DisputeValet.com provides software tools and does not guarantee any specific credit score changes or dispute outcomes.

Getting Started with DisputeValet.com

Quick answers to help you begin your credit repair journey

How do I get started with DisputeValet.com?

Simply subscribe to DisputeValet.com and access it instantly in your browser. No download or installation needed. Enter your credit report information, choose a template for your situation, customize it with our editor, and generate your dispute letter. The whole process takes under 10 minutes.

Do I need my credit reports to start?

Yes, you'll need your credit reports from Equifax, Experian, and TransUnion. You can get them free at annualcreditreport.com. DisputeValet.com helps you identify errors and create targeted dispute letters for each bureau.

How do I send the dispute letters?

After generating your letters in DisputeValet.com, print and mail them via certified mail with return receipt requested. This creates a paper trail and ensures the bureaus receive your disputes. We provide the correct addresses and formatting for each bureau.

What if the credit bureaus reject my disputes?

Our template library includes escalation letters for when initial disputes are rejected. Try different dispute reasons, use validation requests, or escalate to the CFPB. Our templates (20 Standard, 81 Advanced) cover many scenarios, including bureau pushback.

Can I dispute multiple items at once?

Yes, but we recommend being strategic. Start with 3-5 items per bureau for best results. Our dispute tracking dashboard helps you manage multiple disputes and plan your approach. Your subscription allows unlimited dispute letter generation.

No Contracts. No Commitments. Just Tools.

Start with 1 month. Continue only if you love it. Cancel with one click.

Bureaus must respond within 30-45 days by law